Poșta Română, the national postal service of Romania, installed its first Bitcoin ATM at a branch location in the city of Tulcea, in partnership with the Bitcoin Romania (BTR) exchange.

According to an announcement from the postal service, the next locations to receive Bitcoin (BTC) ATMs will be in Alexandria, Piatra Neamț, Botoșani, and Nădlac.

The ATMs are part of a broader push to overhaul existing infrastructure with digital technology and to expand service offerings to underserved areas in the country.

Bitcoin ATMs located inside national post office locations reflect the growing acceptance of cryptocurrencies by lawmakers, national governments and public institutions, which are responding to the increasing demand for digital assets.

Related: Australia rolls out new crypto ATM rules as feds flag rising scams

Bitcoin adoption is heating up, but the total addressable market remains low

Bitcoin adoption is steadily growing through individual investor adoption, businesses accepting BTC as payment, companies or institutions accumulating BTC as a treasury asset, and nation-states buying BTC for national strategic reserves.

In January, crypto exchange Binance said that the number of BTC wallets holding more than $100 in value grew to nearly 30 million. This marked a 25% year-over-year increase.

Despite this growing trend, overall Bitcoin adoption remains low around the world, even in countries with the highest adoption rates.

A Q1 2025 report from River, a Bitcoin financial services company, found that only 4% of the global population owned BTC, with the highest concentration of Bitcoin holders residing in the United States.

An estimated 14% of individuals in the US owned BTC in 2025, the report said.

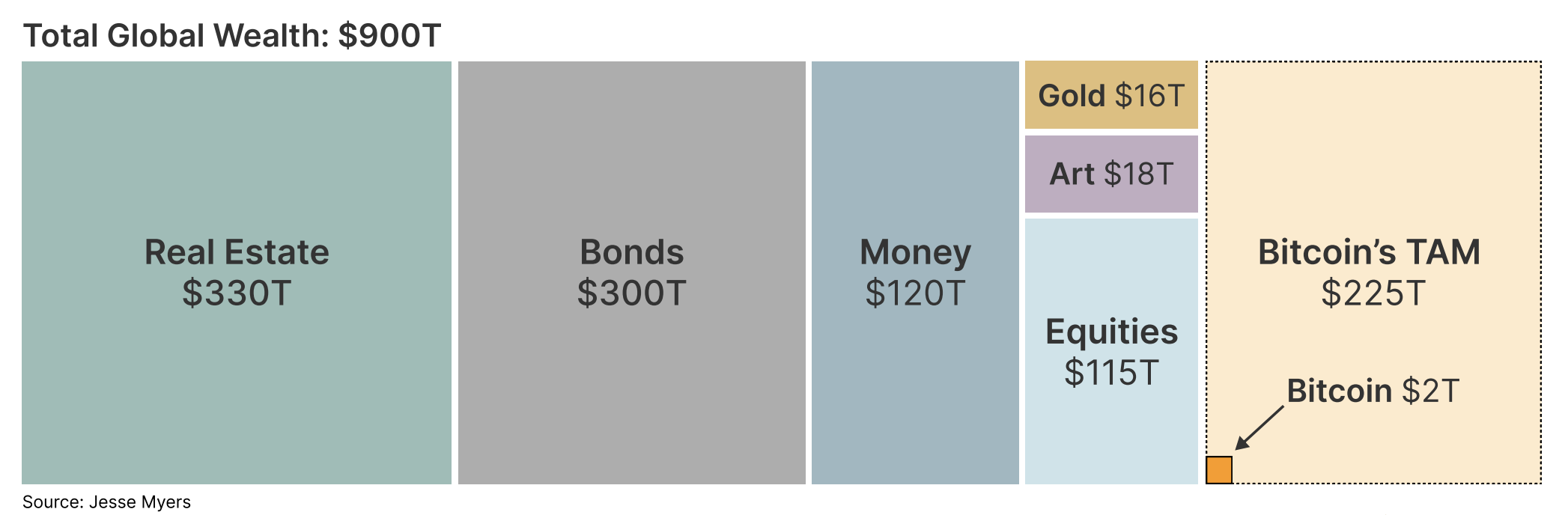

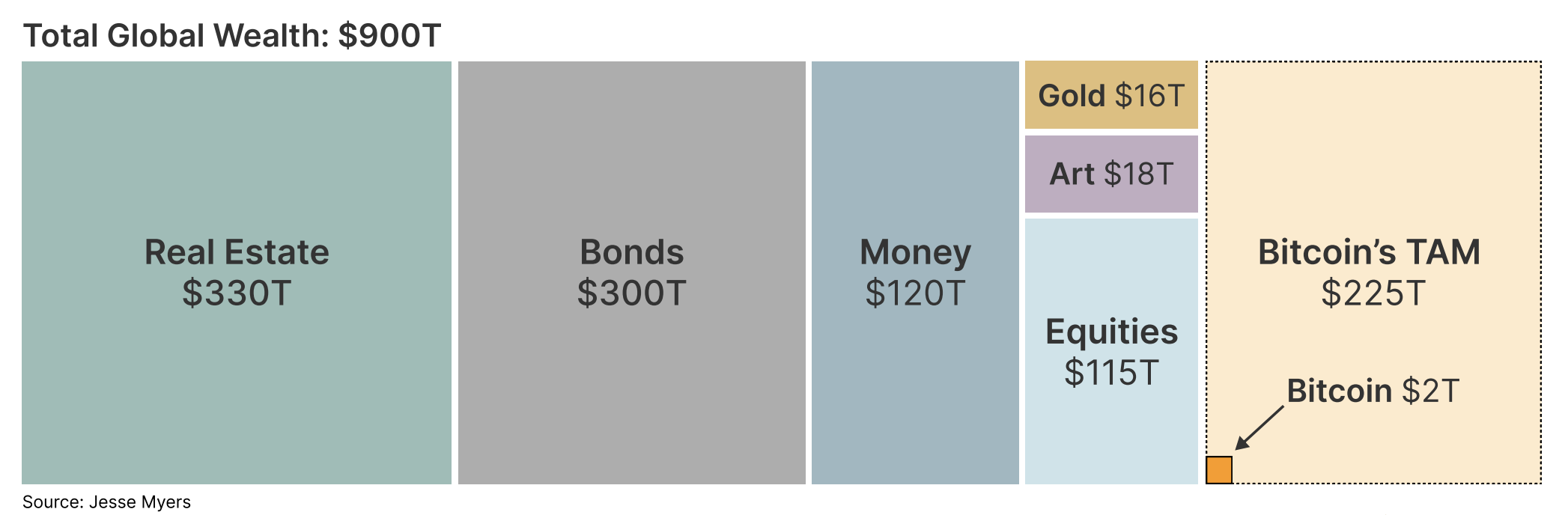

Bitcoin’s total addressable market also remains far below 1% due to low overall retail adoption and institutional under-allocation, according to the researchers.

The analysis assumes that Bitcoin can command 50% of the store-of-value market or roughly $225 trillion in value. These asset classes include cash, equities, real estate, precious metals, and art held for price appreciation or savings.

Bitcoin’s current market cap is just north of $2 trillion. This suggests that Bitcoin still has plenty of room to grow, River concluded.

Magazine: US risks being ‘front run’ on Bitcoin reserve by other nations: Samson Mow

You can contact us for more informations or ads here [email protected]