Key takeaways:

Bitcoin’s weakening MVRV momentum could signal the start of the late stage of the bull cycle.

Spot and onchain transfer volume must recover for BTC price to break out.

BTC bulls must flip the $108,000-$110,000 into new support.

Bitcoin’s 50% rally to $112,000 from its April lows below $74,000 appears to be cooling off, but traders believe that BTC remains on track toward higher targets in 2025.

Several analysts explain what must happen to increase Bitcoin’s potential to break into price discovery in the following days or weeks.

Calm before the storm? MVRV momentum slows

The de-escalation of the Israel-Iran war saw Bitcoin rebound strongly, reclaiming the 50-day simple moving average (SMA) currently sitting around $106,000. Meanwhile, the momentum shown by the market value realized value (MVRV) ratio appears to be stalling, according to CryptoQuant data.

CryptoQuant’s analyst Yonsei_dent said that the current MVRV slump “doesn’t mean a downtrend is imminent.” Instead, it could signal that we are entering the late stage of the bull cycle.

The current MVRV slope at 2.22 is significantly below the overvalued zone (historically above 3.7), suggesting there is still more room for growth.

A pickup in MVRV momentum would suggest that investors hold longer, reducing selling pressure. This, coupled with strong ETF inflows, could trigger Bitcoin’s breakout past its current $112,000 peak, potentially reaching levels above $165,000, as predicted by analysts.

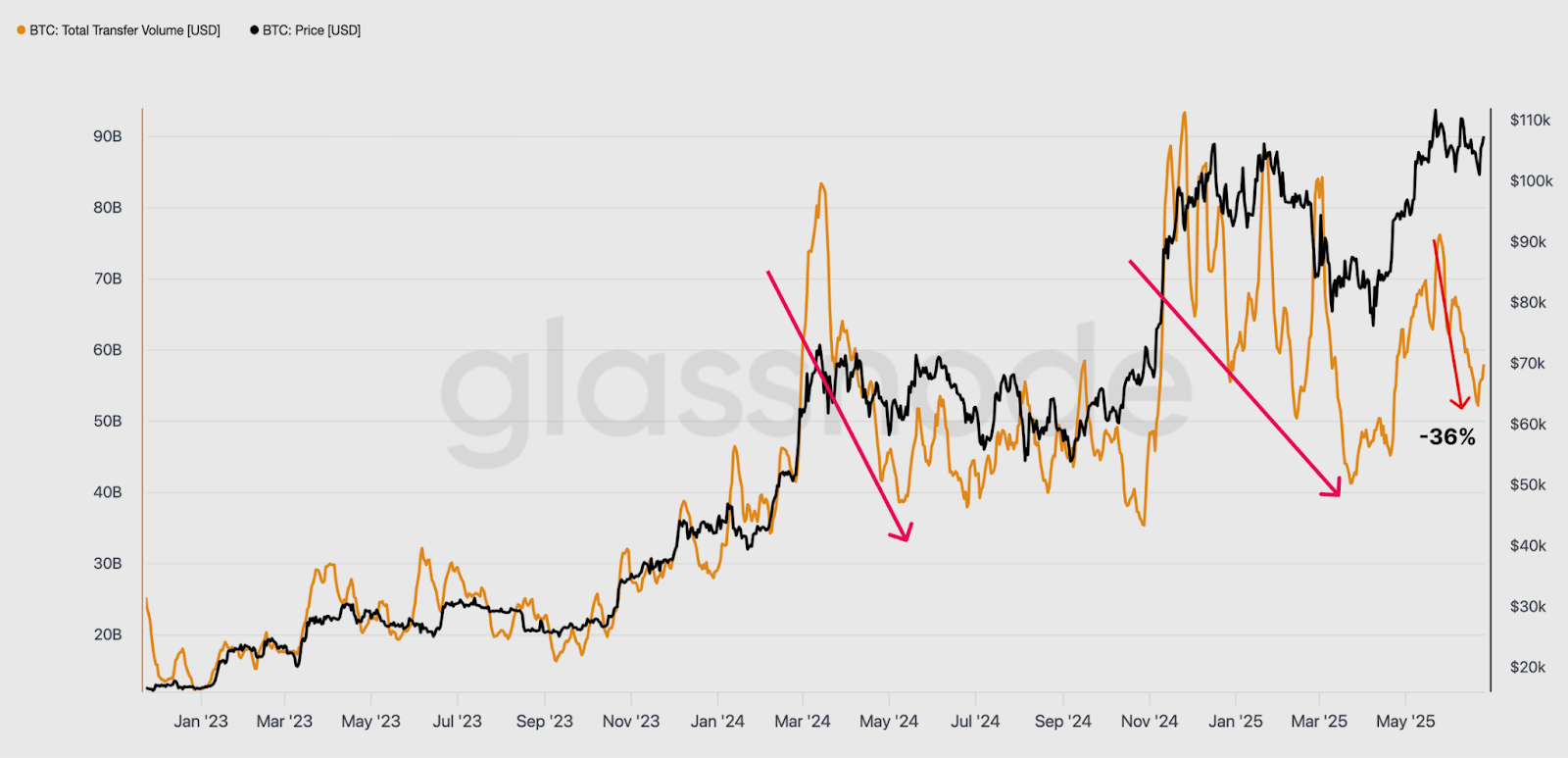

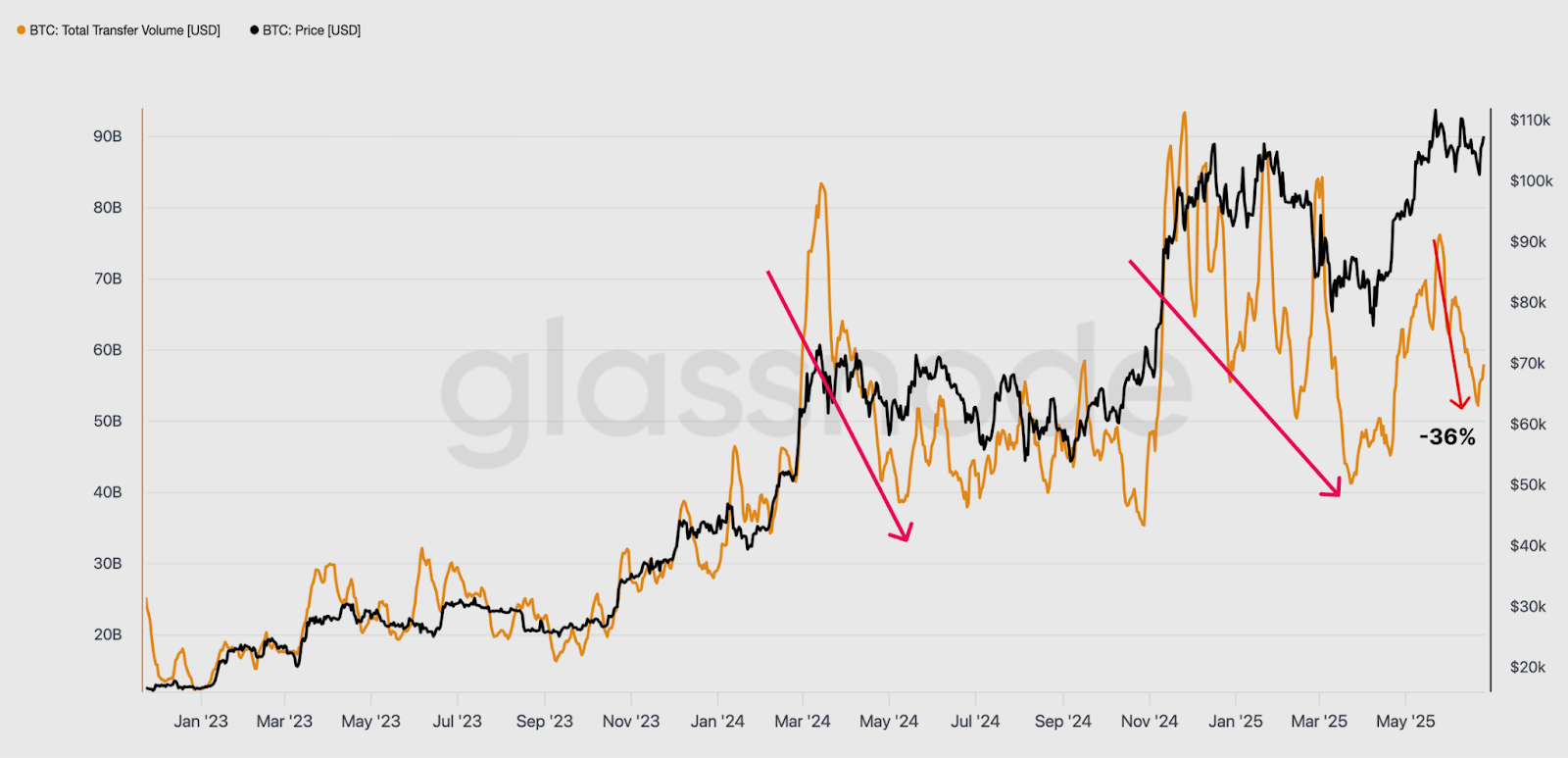

Bitcoin’s onchain transfer volume falls 32%

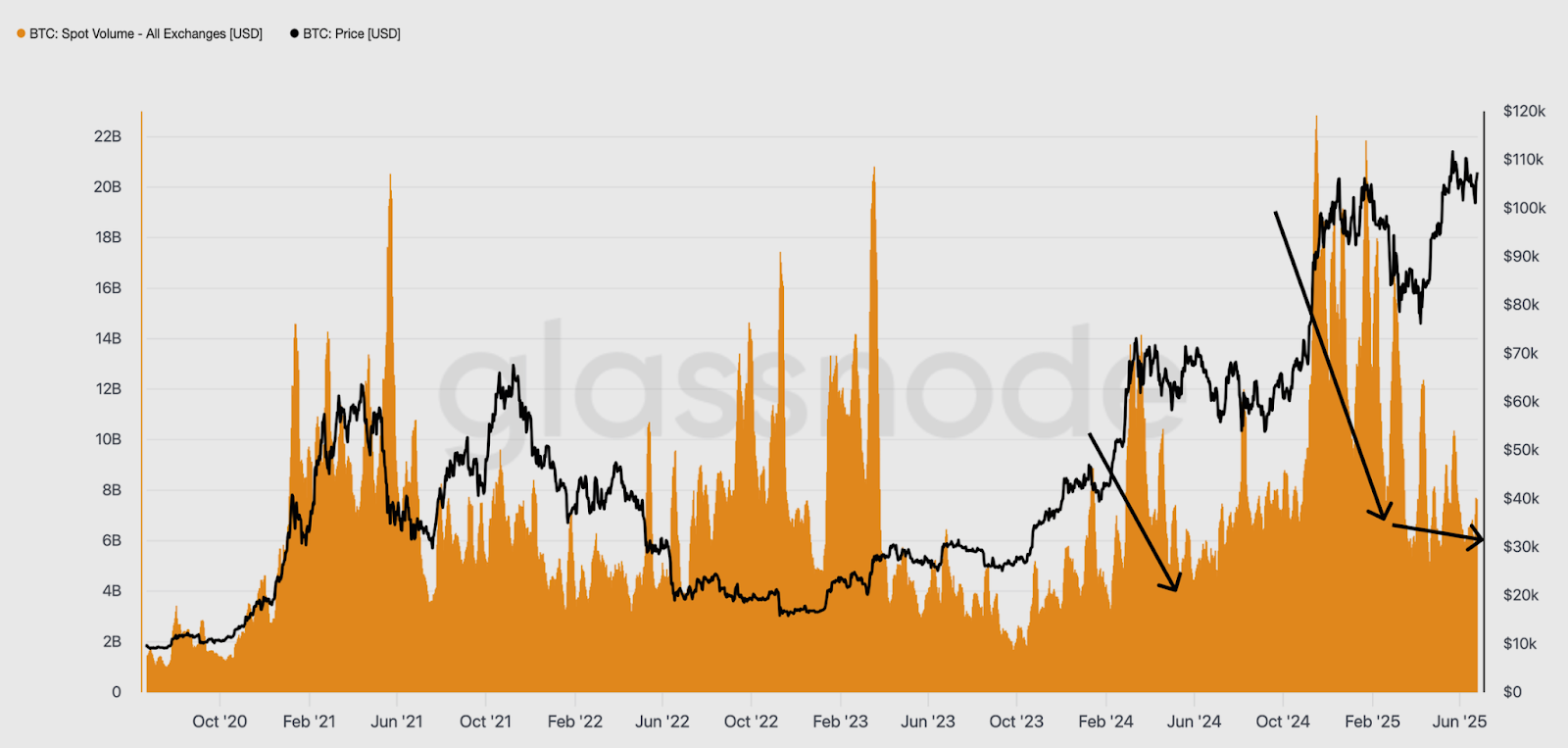

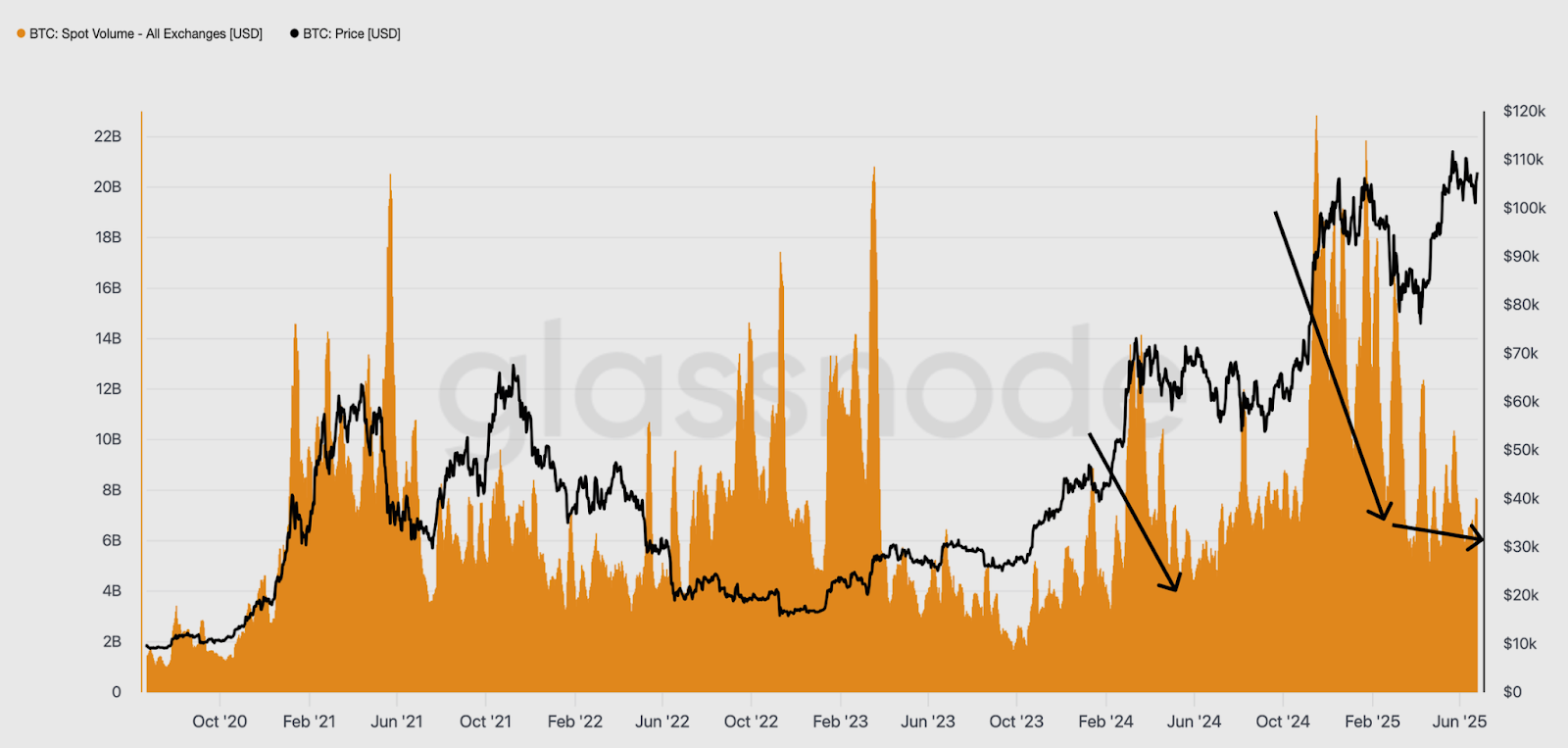

The market appears to be in a cool-down phase as Bitcoin onchain transfer volume and the spot trading volume are down.

Related: Bitcoin ‘Satoshi-era’ miners sold just 150 BTC in 2025 amid all-time highs

The 7-day moving average of onchain transfer volume has dropped by approximately 32% to $52 billion over the last weekend from a peak of $76 billion in late May.

Additionally, current spot trading volume sits around $7.7 billion, significantly lower than the cyclical peaks in this bull market. This divergence further underscores the lack of speculative intensity.

In its latest Week Onchain report, Glassnode said that “unlike the ATH rallies in Q2 and Q4 2024, the recent push to $111K was not accompanied by a surge in spot volume,” adding that it “reflects reduced investor engagement.”

An increase in spot volume reflecting heightened trading activity on exchanges would indicate stronger investor demand and market conviction, as seen in past rallies where spot volume surges preceded price breakouts.

“A real breakout for BTC needs more than just hype,” said crypto market insights provider Alva, adding,

“A high-volume push above $107,500 is the first technical trigger to light the fuse.“

Glassnode concluded that while Bitcoin’s general “bull trend remains intact, a revival in demand, activity metrics and conviction” would increase the odds of a breakout to new highs in the near term.

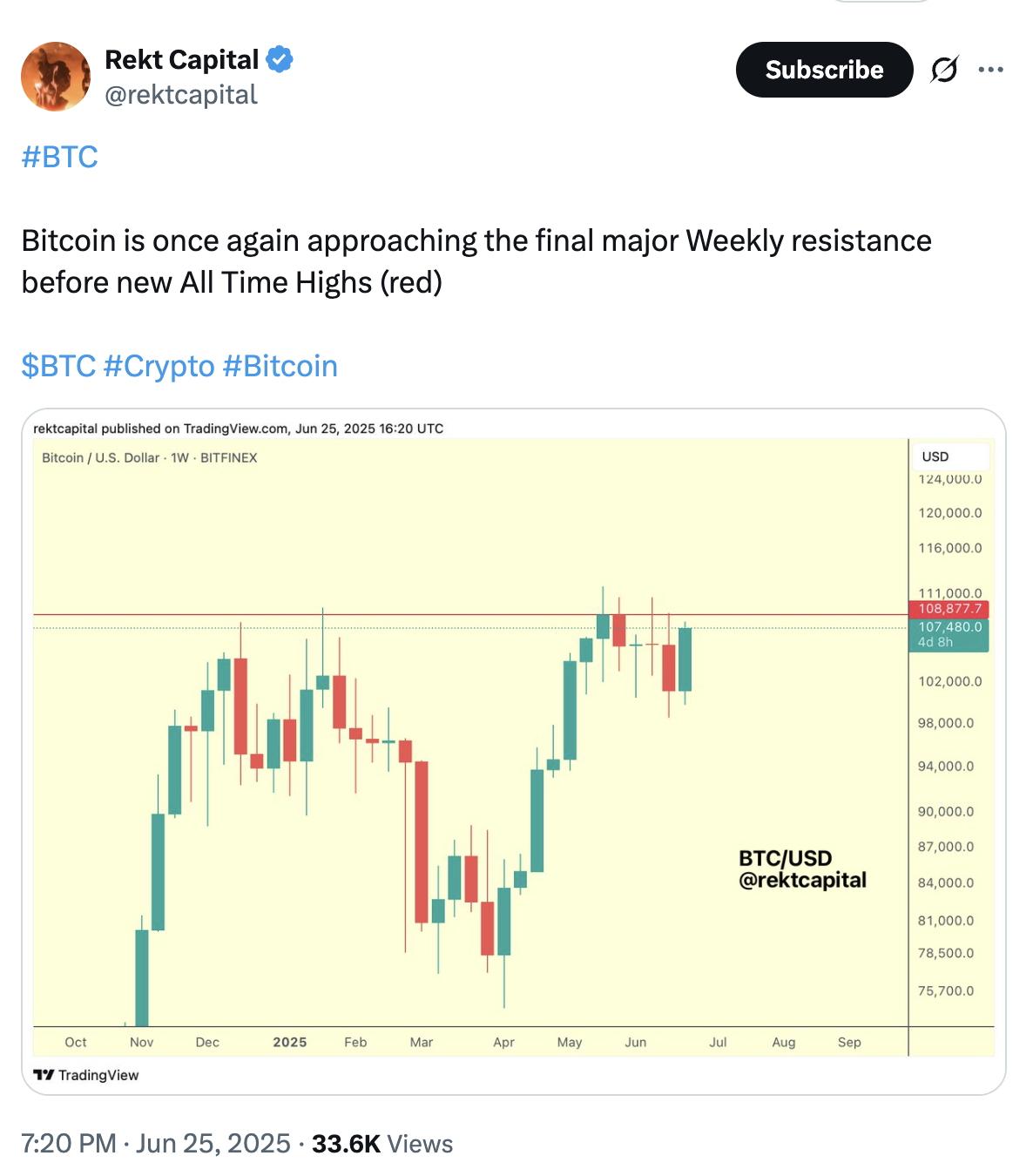

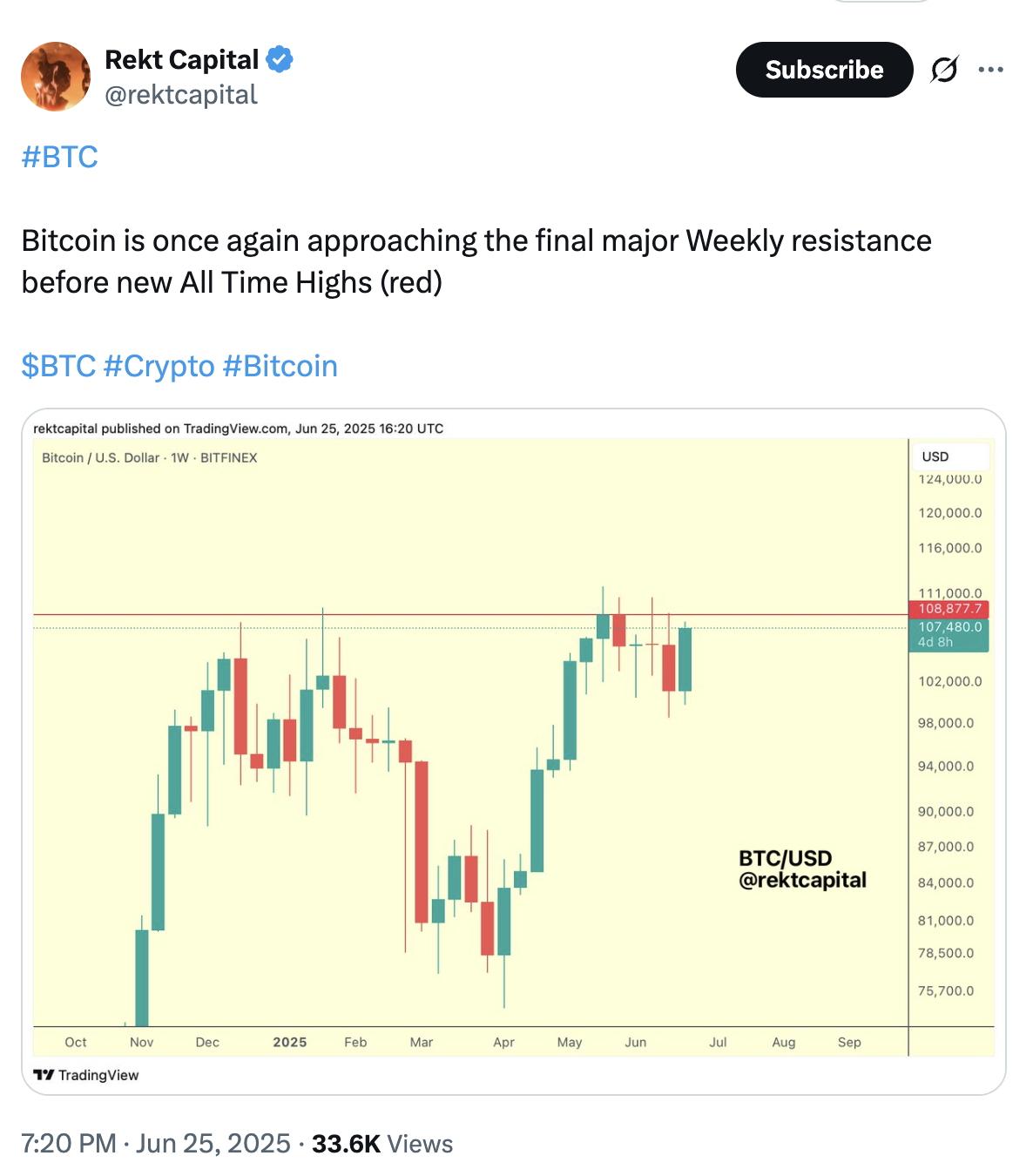

Bitcoin must crack $110,000 resistance

BTC’s price has been oscillating between $110,000 and $100,000, where it has found support, per data from Cointelegraph Markets Pro and TradingView.

Bitcoin’s bullish case hinges on its BTC price flipping the resistance between $108,000 and $110,00 into support.

It is “going to take a big effort to push through the 108K-110K level,” said popular Bitcoin analyst AlphaBTC in a June 26 post on X.

The analyst asserted that the next logical move for Bitcoin would be a pullback to take liquidity around the $105,000-$104,000 zone to gain momentum for a move higher.

“A break and a four-hour close above $109K and new all-time highs are on the cards.”

Fellow analyst Rekt Capital opined that Bitcoin bulls needed to take out the “final major weekly resistance” above $108,000 to reach new all-time highs.

MN Capital founder Michael van de Poppe said that $109,000 was the “area that we need to break in order to have upward momentum,” adding:

“A breakout is about to kick in.”

As Cointelegraph reported, the $108,000-$110,00 was becoming a target for traders thanks to high liquidity clusters up to $111,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

You can contact us for more informations or ads here [email protected]